When you first begin your journey into the world of Sustainability and ESG reporting, the amount of information available can be daunting. Our goal is to make it simpler by providing signposts to help you see the lay of the land quickly. Once you have an overall map of the landscape, you will be better positioned to ask the next set of questions and explore on your own.

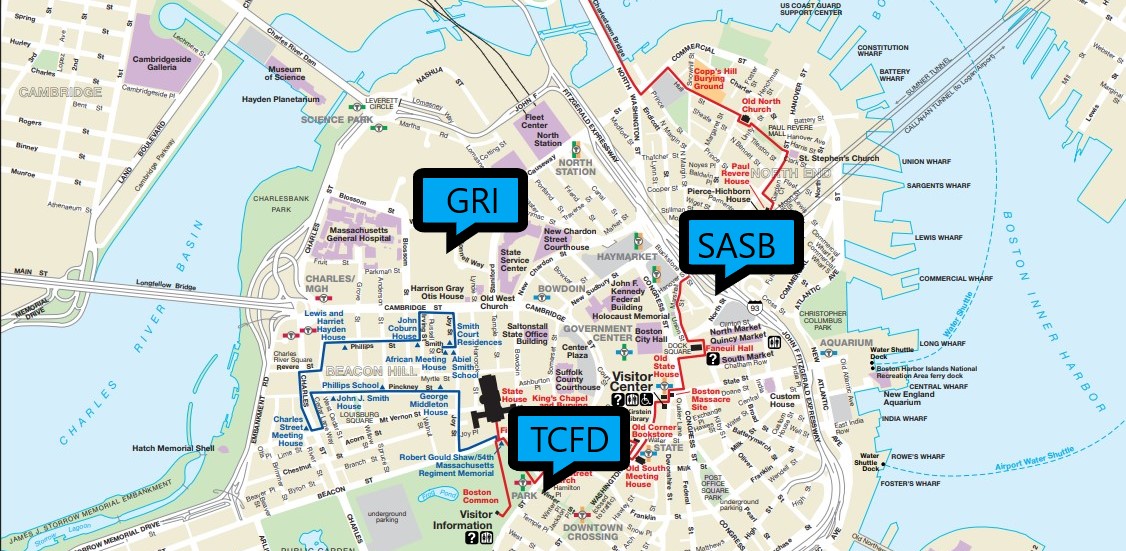

It’s a bit like visiting a big city for the first time: you spend the first morning of your visit looking at maps, and figuring out how to find your way to the main landmarks and restaurant areas from where you are staying. By the second day you know where to get good coffee, how to take public transportation, and feel much more comfortable venturing into new neighborhoods! You will find some of the best resources on the websites of the entities that develop the frameworks and set the standards. Since there are at least thirty of these, here’s a shortlist of four to start with. These were selected because (a) they are the most widely adopted, and (b) they strongly influence the EU and US regulatory frameworks that are coming on-line in 2023.

Four Key Standards / Frameworks

- GHG (Greenhouse Gas) Protocol – first published in 2001. This provides the standard method by which GHG emissions are calculated and reported on and is referenced by all other standards and frameworks (including GRI and SASB) that include emissions reporting as part of their climate disclosures.

- GRI (Global Reporting Initiative) – first publication was released in 2000. The GRI standards comprehensively include environmental, social, operational governance, and economic metrics. Companies use GRI to disclose the most significant economic, environmental, and social impacts that arise from their corporate activities, and how they are taking responsibility for managing those impacts. Reports include a combination of qualitative (e.g. processes for engaging with stakeholders, listings of issues and concerns etc) and quantitative (e.g. actual and target emissions data, employee numbers and demographics etc). A GRI report is intended to be digestible by anyone and to help identify impacts that may become financially material in the future even if they are not today.

- SASB (Sustainability Accounting Standards Board) – first publication was released in 2013. In 2022 SASB came under the auspices of the ISSB (International Sustainability Standards Board) which is part of the IFRS (International Financial Reporting Standards) Foundation. SASB standards broadly encompass environmental, social and governance metrics while being industry-based, highly quantitative and focused on providing financially-material decision-useful information with investors as the primary audience. SASB and GRI collaborate and present their standards as complementary.

- TCFD (Task Force on Climate-related Financial Disclosures) – first publication was released in 2017. TCFD differs from GRI and SASB in that it is narrowly focused on climate-related financial disclosures and is more a “framework” than a “standard”. In fact, the SASB climate-related disclosure standards were designed to align with TCFD recommendations as explained in the TCFD Implementation Guide, and elsewhere.

How these Frameworks relate to US SEC and EU CSRD regulations

Regulators around the world including the Securities and Exchange Commission (SEC) in the United States, and the European Union (through the Corporate Sustainability Reporting Directive, or CSRD) are basing their requirements on these pre-existing frameworks. Since many companies have issued sustainability reports using these frameworks for many years voluntarily, this reduces the additional burden – at least for some.

The proposed SEC Climate Disclosure rule (due in 2023) is influenced by the TCFD and the GHG Protocol. Meanwhile the CSRD, which encompasses the full ESG spectrum, is draws on GRI and SASB, and by extension the GHG Protocol as well.

Other popular frameworks

“Sustainability” touches on so many areas of economic activity that it should not be surprising that there are so many frameworks. Since it is unrealistic for everyone to measure everything, Sustainability Reporting (like accounting) uses a concept of materiality to help companies prioritize. Materiality varies by industry and even by business model within industry, so the list of possible metrics to track across all three pillars of the environment, social and governance gets longer and longer.

On top of it all, the needs of different audiences must also be catered to. Investors are looking for different information from potential employees, or prospective customers. Government policy makers also make use of these resources.

Expertise is needed to create these frameworks, and no one is an expert in every industry and every stakeholder’s point of view, all of which is under constant flux. Which is why so many of them have sprung up, and why they all continue to evolve!

Here are a few more frequently cited frameworks, two of which are now part of IFRS:

- CDP (Carbon Disclosure Project) – is a global system for companies and governmental entities to file environmental disclosures and be scored. Submissions to CDP are aligned with the climate-specific portions of the GRI and SASB.

- CDSB (Climate Disclosure Standards Board) – as of late 2021 this standard has been absorbed into the ISSB (SASB), under the IFRS Foundation.

- IIRC (Integrated Reporting and Connectivity Council) – this standard was also consolidated under the IFRS Foundation in 2021 as the Integrated Reporting Framework which provides connectivity between financial statements and sustainability-related financial disclosures.

- United Nations SDGs (Sustainable Development Goals) – this framework does not include any specific reporting requirements but covers a wide range of economic, social, and environmental issues spread across seventeen goals. Organizations can use them as a reference, and align their sustainability strategies, goals and reporting with specific SDGs that are relevant to their business and stakeholders.